Spotlight

Shining a light on some of the more complicated concepts and terms within your policy.

We realise that there is a lot to take in when you first open your policy booklet! Some of the terminology may be unfamiliar or specific to pet insurance. The purpose of this section is to provide additional information, and examples, of some of the more complex topics. Look out for the ‘lightbulb’ symbol in the policy wording as this will highlight that more information is available here.

The ‘Spotlight’ section does not form part of your policy wording terms and conditions and is intended to be supplementary guidance. Don’t forget though, if there is anything you are not clear on – or need help with how your policy applies to your pet and their health specifically – please call us and we will always try to help.

Bilateral conditions are conditions affecting body parts that your pet has a pair of. For example, ears, eyes, knees, hip joints. When we are applying our terms and conditions, we consider bilateral conditions to be ONE condition. This is the way the policy works rather than it necessarily being scientific fact, so your Vet may feel the conditions are not technically related, but the policy wording requires us to consider them as such.

Example 1: My dog, Hugo, has a Premier Plus policy (£5,000 per condition per year). He has been diagnosed with the same condition in both of his knee joints unfortunately. How is the Veterinary Fees Benefit Limit applied?

In this scenario, Hugo’s condition is considered ‘bilateral’. As such, there will be £5,000 available in each policy period (year) to treat the condition in BOTH knee joints. Remember though, the Benefit Limit for this condition will be fully “re-charged” each time you renew. Furthermore, our Veterinary Fees excess is applied once per condition. As Hugo’s knee problem is considered as ‘one condition’ the excess would only be due when the first claim for it is submitted – not ‘per condition per year’ or ‘per leg’.

Example 2: My cat, Daisy, had an ear infection just before I took her policy out, but it was only in her left ear. Would that mean her right ear won’t be covered?

We will carefully consider Daisy’s medical history in this case. If this indicates an ear infection in the right ear is the same as or related to the condition she had in her left ear before the policy started (a ‘pre-existing condition’) it would not be covered as the condition is then considered to be bilateral.

Here at Vetsure we want you to be confident you have the right level of cover for your pet – both when you first set up a policy and on an ongoing basis. If your requirements change you might decide to change your pet’s level of cover. This guide explains the options available to you, any restrictions in place and helps illustrate the implications of the changes.

Option 1 – ‘Upgrading’ or ‘Downgrading’ your policy type.

With this option you can choose to change the type of policy your pet has by ‘upgrading’ or ‘downgrading’. For example, if you have an Accident Only policy you might choose to ‘upgrade’ to one of our policies that covers both injuries resulting from accidents and illness: ‘Premier’ or ‘Premier Plus’. Conversely, you might decide that you don’t need as much cover and choose to ‘downgrade’.

Restrictions

You can ‘upgrade’ your policy type at any point until your pet reaches their 10th. There is no upper age limit applied for ‘downgrades’ in policy type.

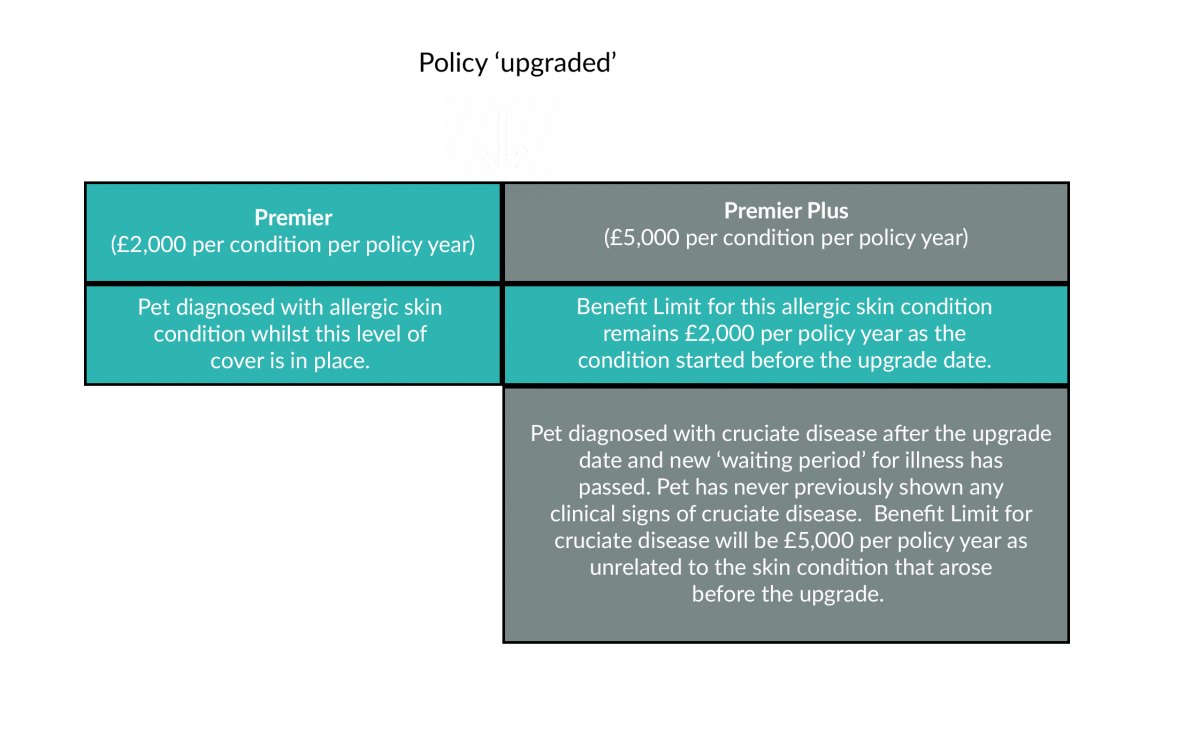

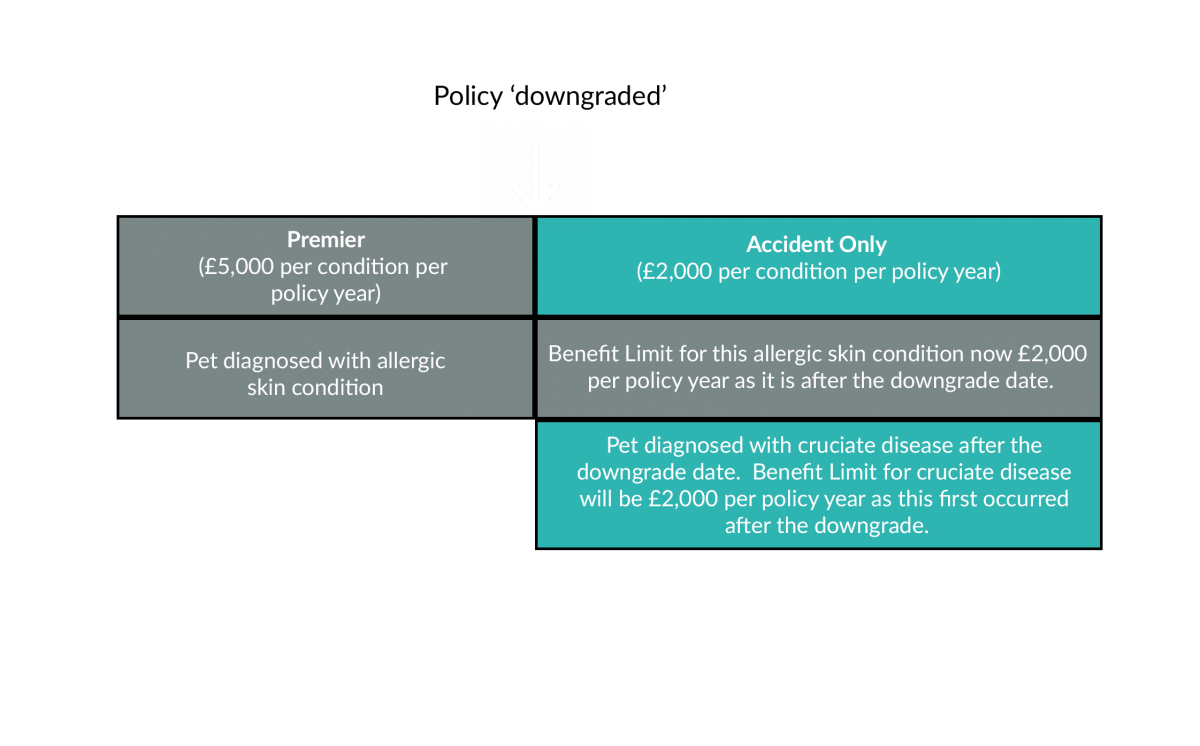

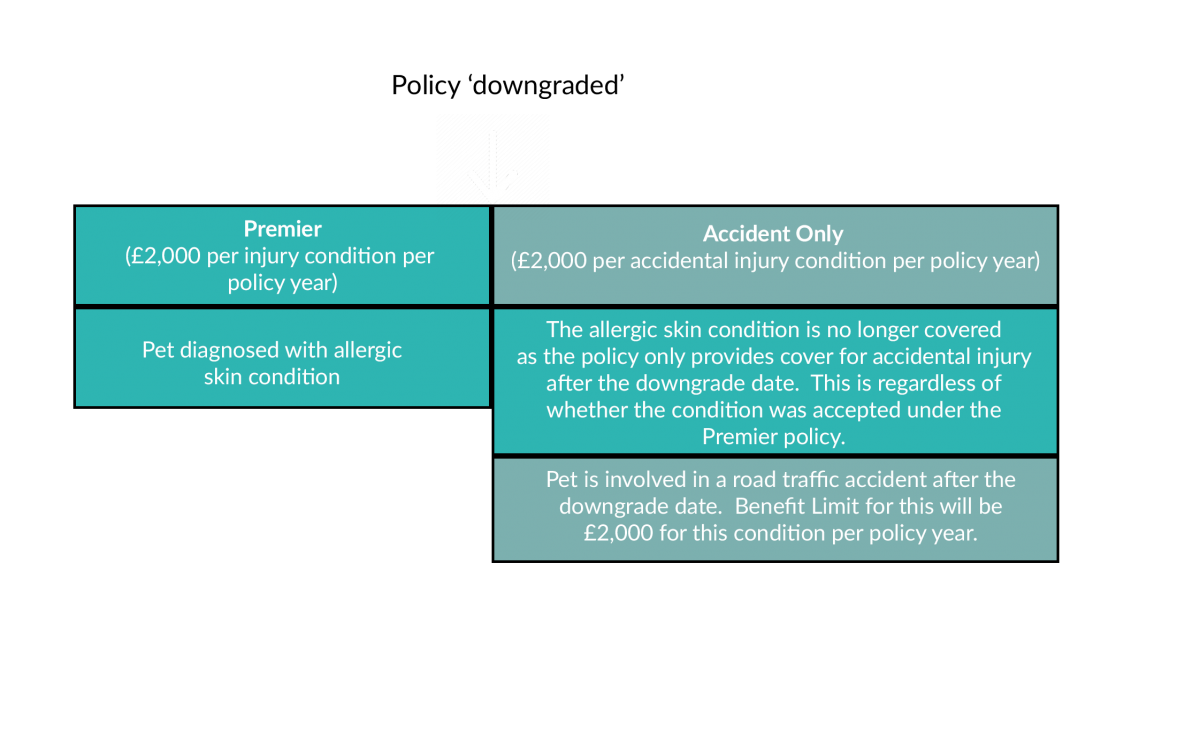

If you upgrade your policy type a new 14-day ‘Waiting Period’ will apply from the effective date of the change. Conditions starting within this waiting period will be subject to the Benefit Limits and terms and conditions in force before the upgrade came into effect. Please also refer to our Definition of ‘Waiting Period’.

Example ‘upgrade’

Example ‘downgrade’ from Premier Plus to Premier

Example ‘downgrade’ from Premier (accident and illness cover) to Accident Only

Option 2 – ‘Topping-up’ your Veterinary Fee Benefit Limit on your existing policy

Option 2 – ‘Topping-up’ your Veterinary Fee Benefit Limit on your existing policy

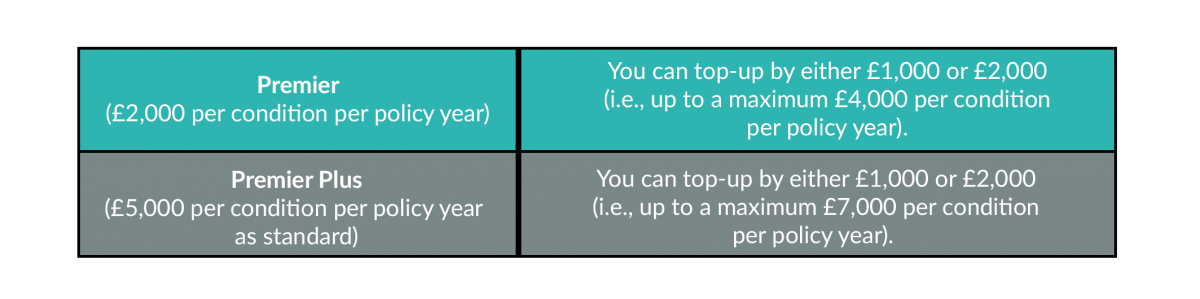

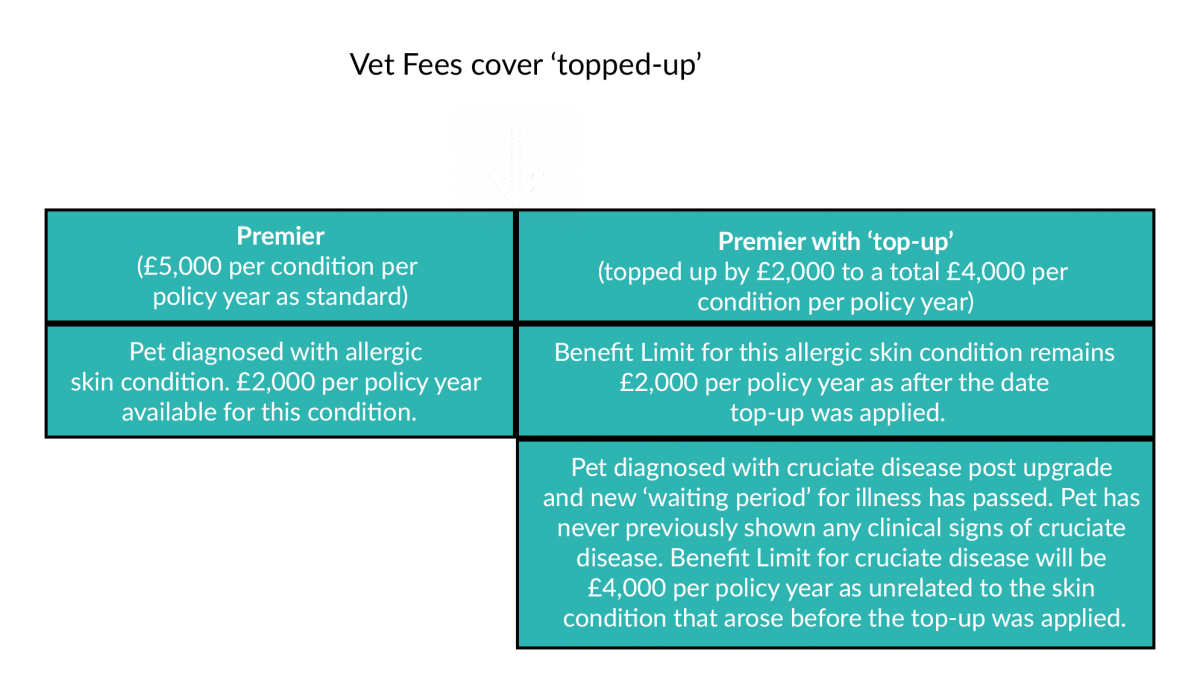

With this option you can choose to keep your existing policy type but change solely the Veterinary Fees Benefit Limit by ‘topping-up’. For example, if you have a Premier policy (which comes with a Vet Fees Benefit Limit of £2,000 per condition per policy year as standard) you might choose to top this up to £3,000 per condition per policy year.

Top-up options available

Restrictions

This option is only available on ‘Premier’ and ‘Premier Plus’ policy types.

You can ‘top-up’ your Veterinary Fees Benefit Limit at any point until your pet reaches their 10th birthday. There is no upper age limit applied when removing or decreasing a top-up.

If you top-up your cover a new 14-day ‘Waiting Period’ will apply from the effective date of the change. Conditions starting within this waiting period will be subject to the Benefit Limits and terms and conditions in force before the top-up came into effect. Please also refer to our Definition of ‘Waiting Period’.

Example cover ‘top-up’

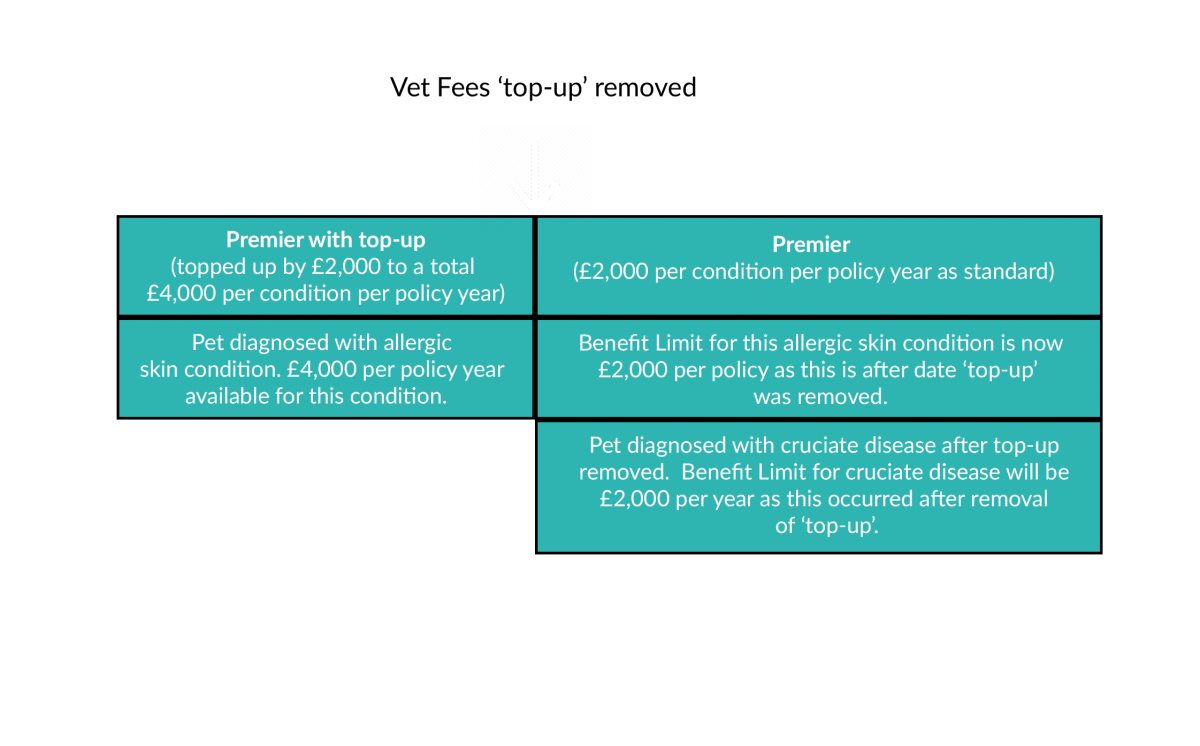

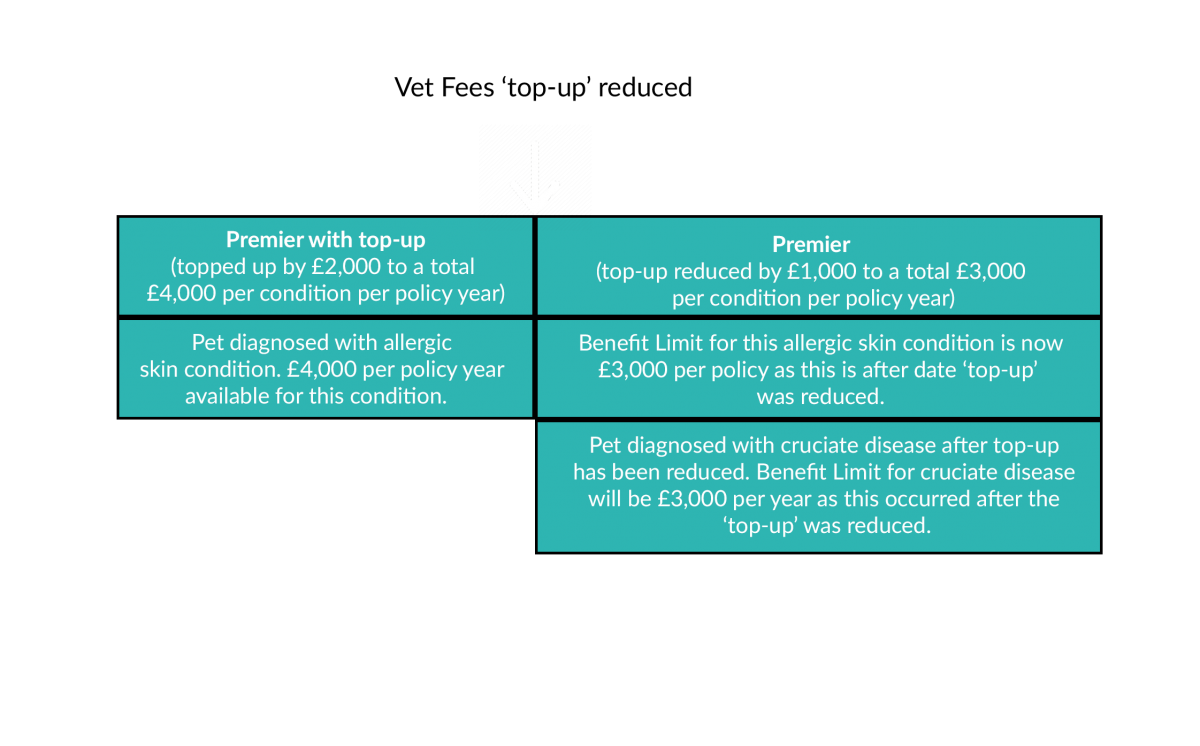

Removing or reducing your Veterinary Fee Benefit Limit ‘top-up’

Example ‘top-up’ removal

Example ‘top-up’ reduced

This information applies to Premier and Premier Plus policies only.

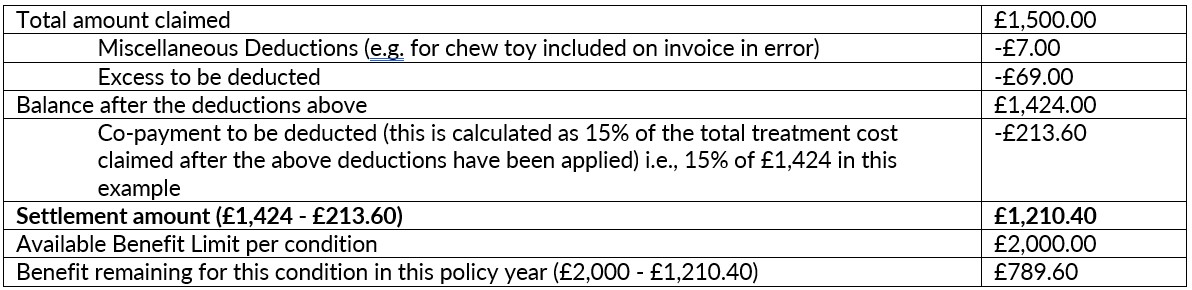

As mentioned in your terms and conditions, for senior pets aged 8 years and over; a 15% co-payment will apply to each and every claim payment for Veterinary Fees, Special Diet and Complementary Medicine, which is in addition to the applicable standard Excess. The co-payment will be calculated as 15% of the treatment cost remaining after your Excess and any other deductions (where applicable) have been subtracted.

Here are some examples to better illustrate this.

Scenario: Truffle is aged over 8 at time of treatment so 15% co-payment applies. His owner has chosen a Premier policy (£2,000 per condition per year) and an Excess of £69 which is payable once only per unrelated condition.

Claim number 1

Truffle has unfortunately developed cruciate disease and has undergone surgery. A claim is submitted with a veterinary bill of £1,500. The settlement is broken down as follows:

Claim number 2

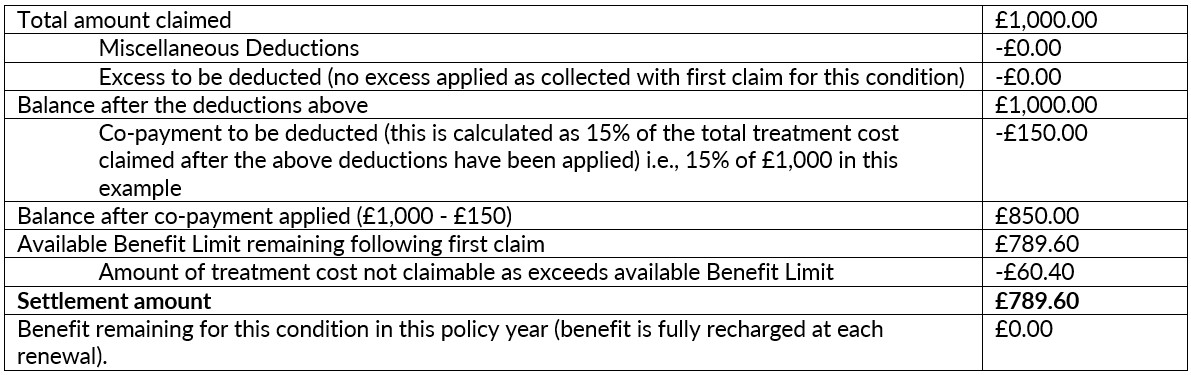

Truffle has required some further surgery for his cruciate disease within the same policy year. A ‘continuation claim’ is submitted for a treatment cost of £1,200 (e.g., treatment cost has exceeded benefit remaining for this condition in this policy year). The settlement is broken down as follows:

Claim number 3

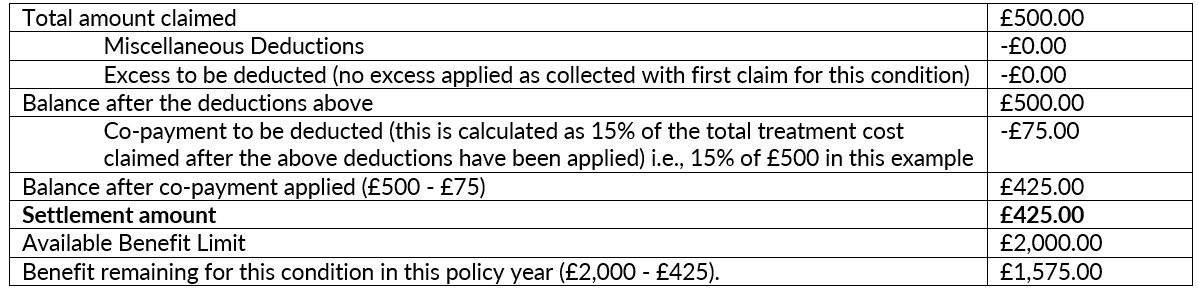

Truffle’s policy has now renewed for another year and his policy Benefit Limits have been fully recharged. A further ‘continuation claim’ is submitted for a treatment cost of £500. The settlement is broken down as follows:

As mentioned above, The Benefit Limit for ‘Veterinary Fees’ is claimable per unrelated illness or injury condition per policy period. The ‘Complementary Medicine’ and ‘Special Diet’ are sub-sections of the ‘Veterinary Fees’ section but have Benefit Limits that apply per policy year.

For example, Toffee the dog is unfortunately involved in a road traffic accident (RTA). Thankfully, he has some orthopaedic surgery which is covered by his policy, but he also needs some hydrotherapy to support his recovery. Toffee has a Premier Plus policy which provides £5,000 per condition per year for Veterinary Fee claims and £1,000 per policy year for Complementary Medicine. Toffee has a £69 excess on his policy.

This is how Toffee’s claim (which occurred in same policy year) breaks down.

Cost of initial surgery and treatment = £2,500.

Cost of Hydrotherapy sessions = £500.

£69 excess chosen.

Amount of Veterinary Fee benefit remaining for this condition in this policy year:

£5,000 – (£2,500 + £500 + £69) = £3,069.

Amount of Complementary Medicine benefit remaining in this policy year (which can be used for any eligible condition, not just for Toffee’s RTA treatment):

£1,000 – £500 = £500.

When Toffee’s policy is renewed his Benefit Limits will be recharged and he will have:

£5,000 per condition per year available for Veterinary Fees

£1,000 per year available for Complementary Medicine (which, as explained above, is included within the Veterinary Fees Benefit Limit).

Lumps (which might also be referred to as “growths”, “masses” or “tumours”) that are considered to be of the same ‘type’ are treated as the same condition. Here are some examples of how this would apply in the context of the policy wording:

Choosing one of our policies could not be easier. If you just want to make a quick choice, you can select one of our three core policies. If you have specific requirements you can tailor your policy to meet your exact needs.

View our policies to learn more

We have collated this information for any of our customers who are uncertain of the cover level they might need. Here at Vetsure, we believe our customers should be able to access information that will help make the right decision for them and their pets. However, it is important to highlight that we cannot give advice or make recommendations regarding your choice of policy and it is ultimately the responsibility of all customers to ensure their policy meets their requirements.